2024 Hsa Maximum Contribution Limits

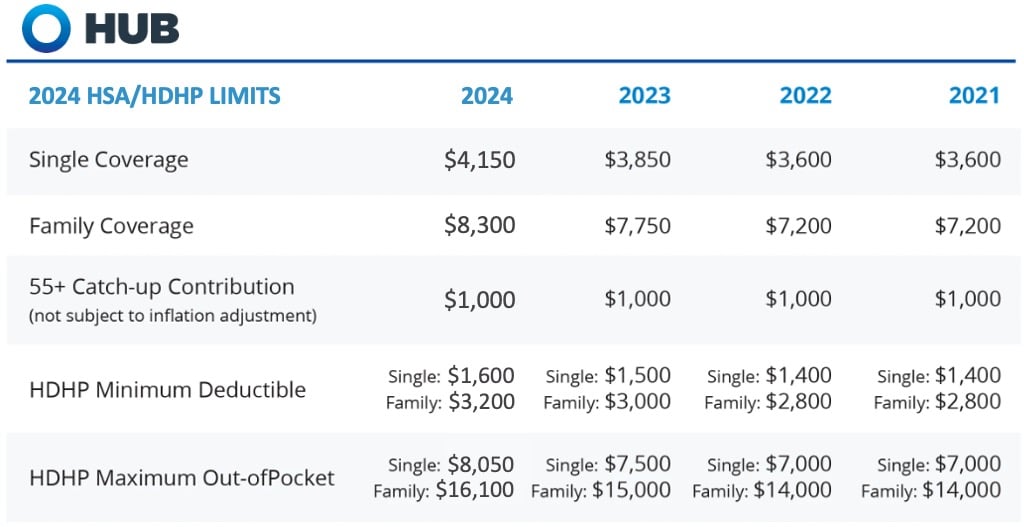

2024 Hsa Maximum Contribution Limits. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families. The limits are increasing from 2023 to 2024.

The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. Those age 55 and older can make an additional $1,000 catch.

But If You Do Have An Fsa In 2024, Here Are The Maximum Amounts You Can Contribute For 2024 (Tax Returns Normally Filed In 2025).

(people 55 and older can stash away an.

Hsa Members Can Contribute Up To The Annual Maximum Amount That Is Set By The Irs.

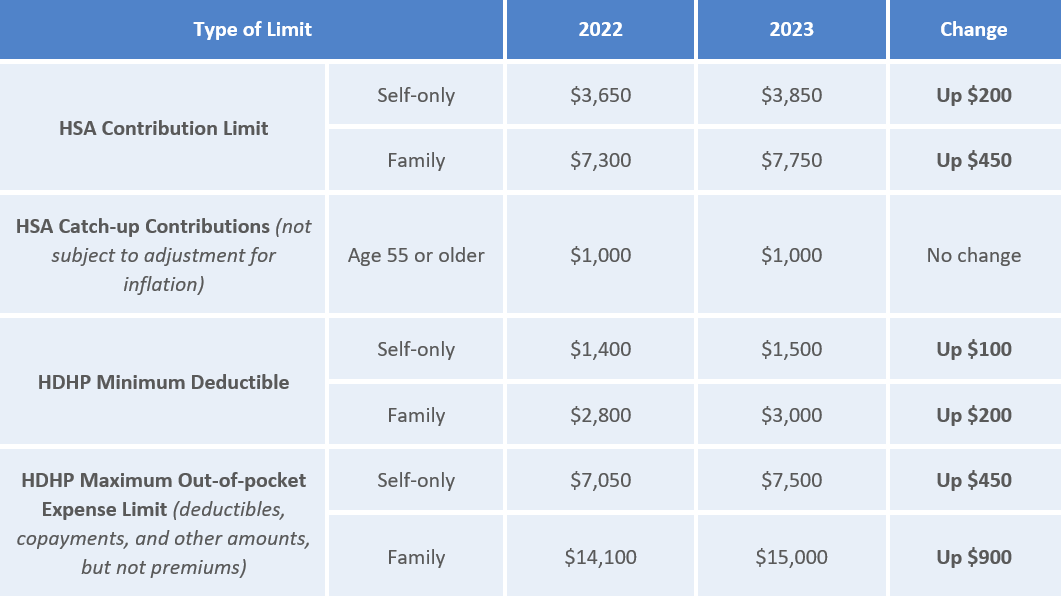

Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families.

In May, The Irs Announced A Significant Increase To The Annual Hsa Contribution Limit For 2024.

Images References :

Source: adalinewcarlin.pages.dev

Source: adalinewcarlin.pages.dev

2024 Compensation Limit Filia Klarrisa, Hsa members can contribute up to the annual maximum amount that is set by the irs. The hsa contribution limit for family coverage is $8,300.

Source: emmaleewdonica.pages.dev

Source: emmaleewdonica.pages.dev

Aptc Limits 2024 Gwenny Stepha, Sign up for your health savings account with lively. The maximum contribution for family coverage is $8,300.

Source: bunniqzaneta.pages.dev

Source: bunniqzaneta.pages.dev

2024 Defined Contribution Limits Cammy Caressa, The hsa contribution limit for family coverage is $8,300. $4,150 for single coverage ($300 increase from $3,850) $8,300 for family coverage ($550 increase from.

Source: www.newfront.com

Source: www.newfront.com

Significant HSA Contribution Limit Increase for 2024, Hsa contribution limits for 2023 are $3,850 for singles and $7,750 for families. The maximum contribution for family coverage is $8,300.

Source: admin.itprice.com

Source: admin.itprice.com

2023 Dcfsa Limits 2023 Calendar, The new 2024 hsa contribution limit is $4,150 if you are single—a 7.8% increase from the maximum contribution limit of $3,850 in 2023. But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

Source: heartsleeveshare-jng9bds84c.live-website.com

Source: heartsleeveshare-jng9bds84c.live-website.com

HSA/HDHP Limits Will Enhance for 2024 Heart Sleeve Share, Hsa contribution limits for 2024. The health savings account (hsa) contribution limits increased from 2023 to 2024.

Source: mint.intuit.com

Source: mint.intuit.com

What’s the Maximum 401k Contribution Limit in 2022? MintLife Blog, Hsa contribution limits for 2024 are $4,150 for singles and $8,300 for families. For 2024, the maximum hsa contribution will jump to $8,300 for a family and $4,150 for an individual.

Source: blog.threadhcm.com

Source: blog.threadhcm.com

IRS Announces 2023 HSA Contribution Limits, The maximum contribution for family coverage is $8,300. If you want to put more money in an hsa this year, make sure you don’t exceed the applicable contribution limit.

Source: www.bccbenefitsolutions.com

Source: www.bccbenefitsolutions.com

HSA/HDHP Contribution Limits Increase for 2023, The maximum contribution for family coverage is $8,300. The maximum amount of money you can put in an hsa in 2024 will be $4,150 for individuals and $8,300 for families.

Source: www.linkedin.com

Source: www.linkedin.com

Lively, Inc. on LinkedIn 2023 and 2024 HSA Maximum Contribution Limits, View contribution limits for 2024 and historical limits back to 2004. The hsa contribution limit for family coverage is $8,300.

The Irs Announced The 2024 Hsa Maximum Contribution Limits.

But if you do have an fsa in 2024, here are the maximum amounts you can contribute for 2024 (tax returns normally filed in 2025).

The New 2024 Hsa Contribution Limit Is $4,150 If You Are Single—A 7.8% Increase From The Maximum Contribution Limit Of $3,850 In 2023.

Plus, participants who are age 55 and older can save an.