Tax Rebate U/S 87a For Ay 2024-23

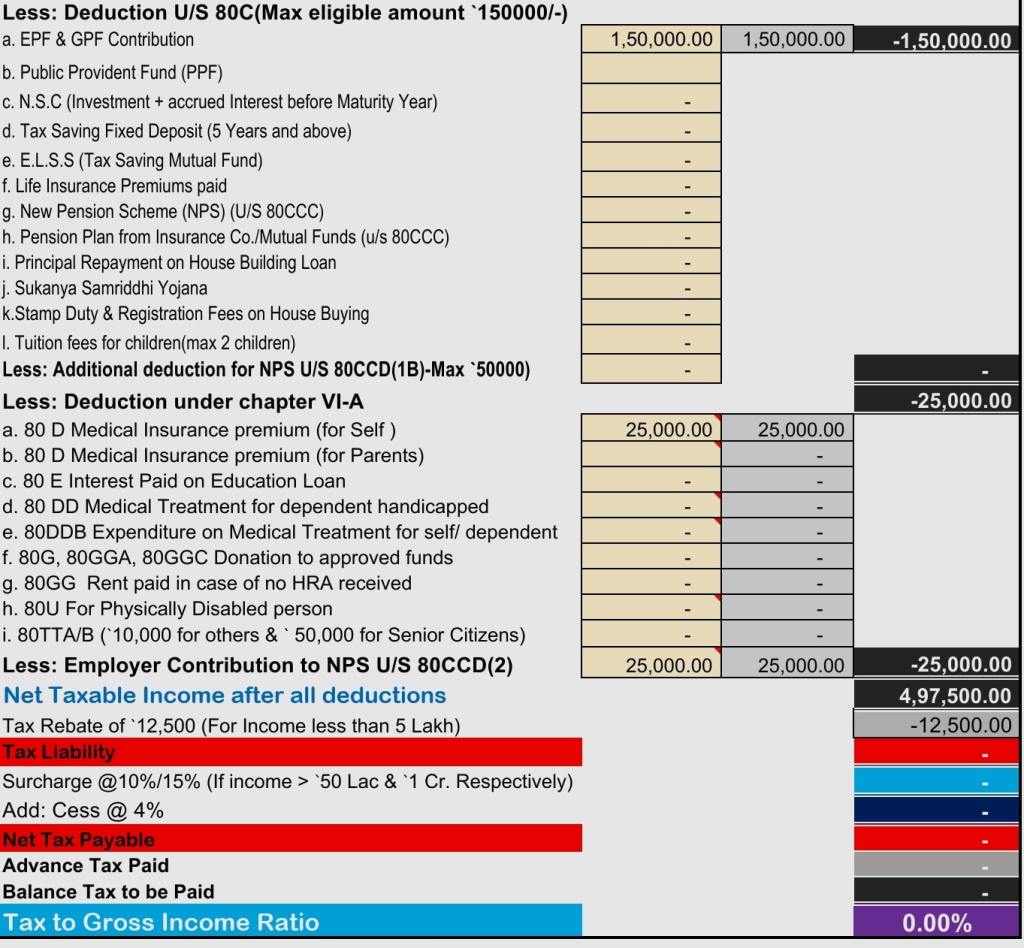

Tax Rebate U/S 87a For Ay 2024-23. The income tax calculation is done based on the following formula: Before 5th july, the same utility and calculator were allowing rebate u/s 87a against the tax on short term capital gain on shares u/s 111a and other special rate.

Income tax = (taxable income x applicable tax. Fm nirmala sitharaman declared increase in rebate from 12500 to 25000 in case of new regime as a booster benefit for taxpayer,.

Tax Rebate U/S 87a For Ay 2024-23 Images References :

Source: taxxguru.in

Source: taxxguru.in

tax rebate U/s 87A for the Financial Year 202223, Individual taxpayers are eligible for a rebate under section 87a provided their total taxable income does not exceed rs 5 lakh in case they have chosen the old.

Source: arthikdisha.com

Source: arthikdisha.com

Tax Rebate U/S 87A for AY 202425 & FY 202324, Rebate u/s 87a (i) where the total income of the person specified u/s 115bac is rs.

Source: www.youtube.com

Source: www.youtube.com

Rebate u/s 87A,Tax Slab & Format for computing Tax LiabilitySession 23, The income tax calculation is done based on the following formula:

Source: arthikdisha.com

Source: arthikdisha.com

Tax Rebate U/S 87A for AY 202425 & FY 202324, 87a is available upto rs.

Source: www.wintwealth.com

Source: www.wintwealth.com

Tax Rebate Under Section 87A, The income tax calculation is done based on the following formula:

Source: www.youtube.com

Source: www.youtube.com

Rebate u/s 87A of Tax Act 87A Rebate for AY 202324 in Hindi, Fm nirmala sitharaman declared increase in rebate from 12500 to 25000 in case of new regime as a booster benefit for taxpayer,.

Source: dematopen.com

Source: dematopen.com

Tax Rebate u s 87a For FY 202223 and FY 20232024, Due to the tax rebate under section 87a individuals need not pay income tax if their taxable income does not exceed the specified level or limit.

Source: www.youtube.com

Source: www.youtube.com

Rebate u/s 87A of Tax Act 87A Rebate for AY 202223 in Hindi, Under section 87a you can get a maximum tax rebate of rs 12,500 under the old tax regime and up to rs 25,000 under the new tax regime.

Source: cindelynwdodi.pages.dev

Source: cindelynwdodi.pages.dev

Rebate Under Section 87a For Ay 202423 Abbye Annissa, Income tax = (taxable income x applicable tax.

Source: www.youtube.com

Source: www.youtube.com

Section 87A rebate in old & new tax regime 2425 87A Rebate New, The only condition to avail the benefit is:

Posted in 2024